Bitcoin surpasses Meta's market cap following unexpected 25% sell-off

Bitcoin has unexpectedly overtaken Meta in market cap following a vicious sell-off in shares that saw the value of Facebook’s parent company drop more than 25%.

The stock sell-off, which was prompted by a disappointing Q4 earnings report, saw the biggest wipeout in market history from Meta, setting the stage for Bitcoin to jump in and enter the coveted top 10 companies valued by their market capitalisation.

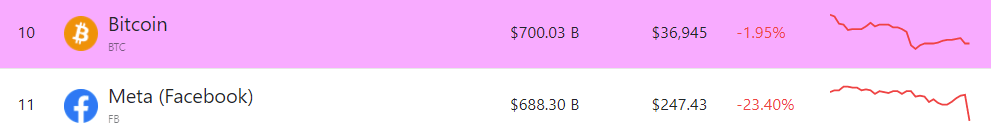

The heavy freefall in Meta’s price now means that, as it stands, Bitcoin’s market cap of $700bn has briefly surpassed the $688bn of Meta.

A $200bn sell-off in Facebook stocks saw the market capitalisation of Bitcoin nab the top ten spot. Source

Both Bitcoin and Meta have previously reached a market capitalisation of more than $1 trillion but have faced recent losses in the markets. Bitcoin, the world’s largest cryptocurrency, remains in a downtrend on all time frames after struggling to break through a resistance of $39,000.

It currently sits at just below $37,000 despite a number of bullish catalysts including MicroStrategy purchasing a further 600 Bitcoin for $25m and increased adoption and acceptance across both legacy and mainstream markets.

However, for Meta, the misery continued as it saw user numbers decline alongside posting a $10bn loss in its metaverse business.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire