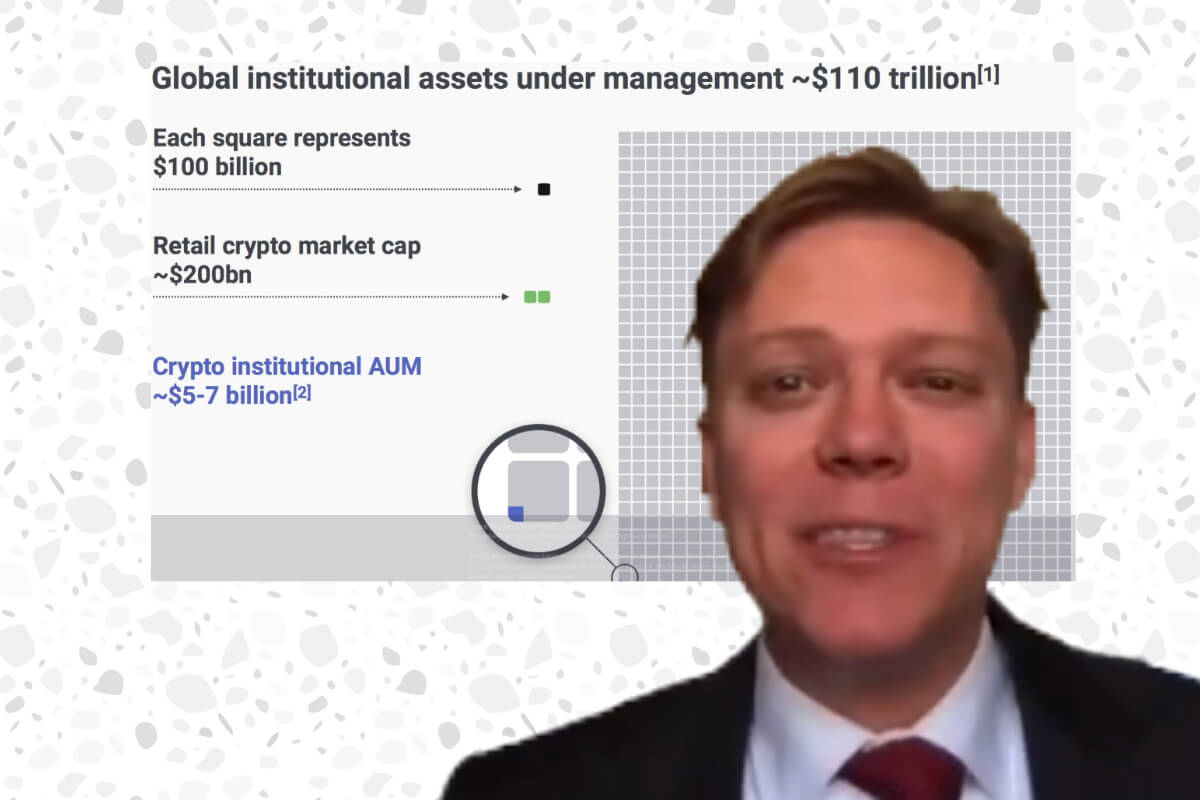

According to Bitcoin OG Trace Meyer, of the $110 trillion of global institutional assets under management, institutional investors have only put $5-7 billion into Bitcoin or crypto.

Trace took to Twitter to claim that the vast majority of capital allocated into the crypto asset class today has come from the retail market.

In his tweet, the host of the Bitcoin Knowledge podcast mentioned that to date, “Essentially no capital [has been] allocated to Bitcoin or cryptocurrencies.”

He went on to say that as a sterile asset class, any “BTC price increase is a wealth transfer from other assets. A black hole on the world’s balance sheet will be legendary.”

If his analysis is correct, then it’s amazing to think of any prior investment class in history where the majority of the early gains were made (or even had the possibility to be made) by retail investors. From his post, you can see that of the $207 billion invested in crypto to date, a whopping 97% has come from the retail market.

Another key takeaway is, of course, the relative lack of global exposure to crypto in general. Crypto looks to have only penetrated 0.18% of global assets under management. Most conservative Wall Street analysts who acknowledge a possible future for this asset class recommend a low single-digit allocation to crypto.

People like billionaire and Silicon Valley venture capitalist Chamath Palihapitiya also recommend that investors have a 1% Bitcoin allocation. He encourages people to do this to prudently hedge against fiat-associated risk that most likely encompasses the other 99% of people’s investable assets.

From an interview he gave to CNBC in 2018, Chamath shared the opinion that if there is a 1% chance that Bitcoin may one day rival a state-backed world reserve currency, then it makes sense to allocate the same percentage of your portfolio as an insurance policy.

A few days ago, Trace posed a question to his Twitter followers: “How did the USD altcoin scam arise?”

He gave a brief history of the different layers of money, saying that: “Newton invented gold standard. 2nd layer [money] was warehouse receipts, [then] Gauss & Morse invented the telegraph which was used for 3rd layer wire transfers.”

Trace also recently called out the FDIC (Federal Deposit Insurance Corporation), suggesting that they have weaponised the USD political currency to “choke out” legal businesses by denying them banking and processing services. However, he claims that “neutral Bitcoin, like gravity, enables all to make BTC payments others try to prevent.”

Trace was the chief architect of this year’s proof of keys day. On January 3rd this year, we saw 290,000 BTC transactions take place. This is compared to 400,000 BTC transactions that took place on the same day last year (at the height of the crypto bull run).

Looking at the amount of BTC moved, we see another disappointing drop from the previous year, with around 150,000 Bitcoin moved on the blockchain compared to 250,000 a year ago.

Trace seems convinced that institutional players are still waiting on the sidelines. With new institutional products due to launch this year from Bakkt, and maybe even an ETF approval, this may be what this powerful group of investors are waiting for before looking to increase the total invested in crypto.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire