Looking at just the prices of ETH and altcoins, February would seem like a sideways month, perfect for swing trading, but not many significant developments in the market. However, it was actually pretty important for a number of reasons.

Until last month, OpenSea was the largest marketplace for trading by far, with no other platforms having a serious shot of becoming the model for NFT marketplaces 2.0. Then came Blur, which exploded in February with its high-performance aggregation product.

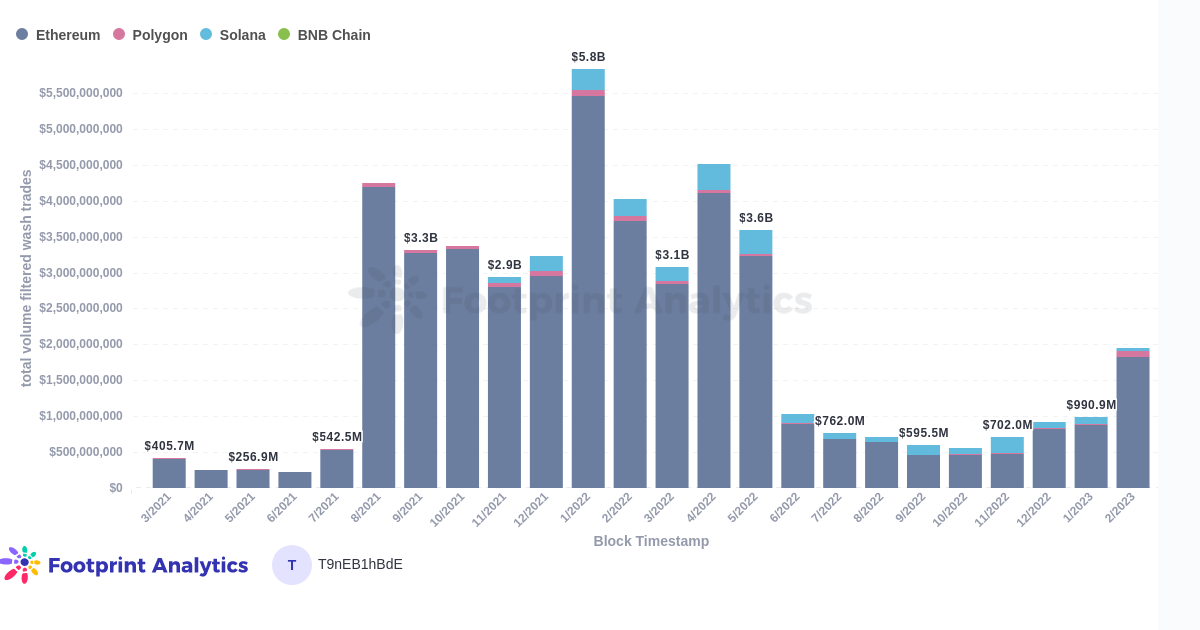

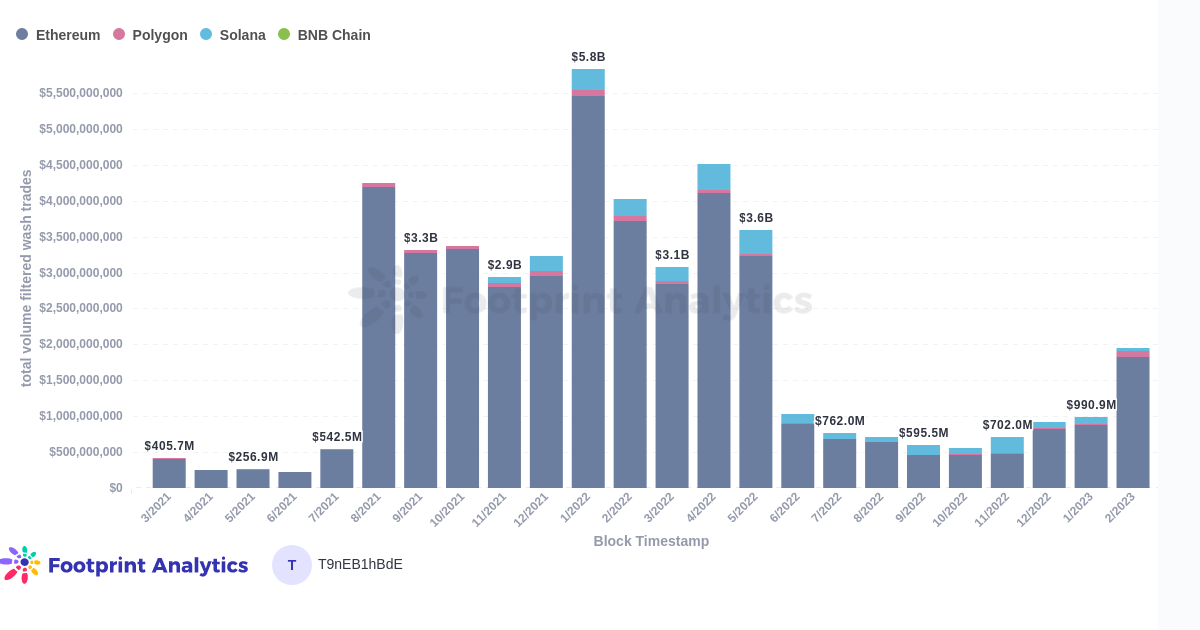

Polygon, which has been strong for DeFi and GameFi in the bear market, has overtaken Solana to become the second largest chain by NFT trading volume.

Finally, Amazon backed a largest round in February, giving a top digital collectibles project strong support to tap into its vast entertainment empire and therefore the general public.

All-in-all, these developments should be seen in light of a generally positive sentiment regarding the crypto market compared to previous quarters, with ETH decorrelating from traditional equities markets in a positive direction.

Key Findings

Crypto Macro Overview

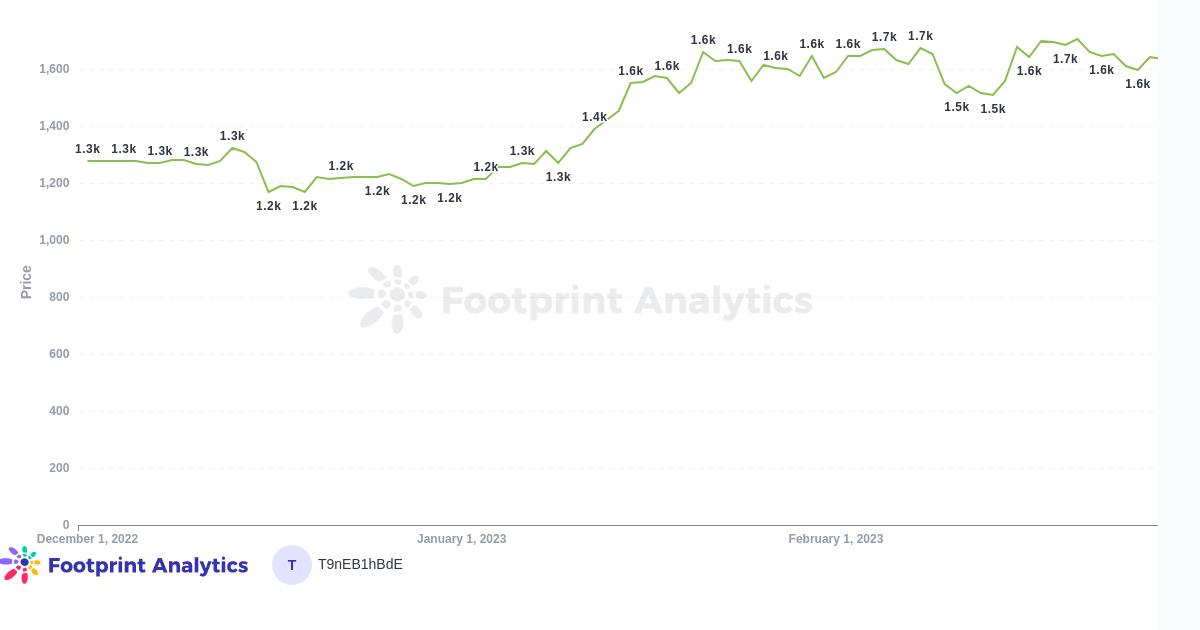

- ETH remained in a similar range as it closed in January, except for a sharp drop to $1,506 on Feb. 13 followed by a recovery

NFT Market Overview

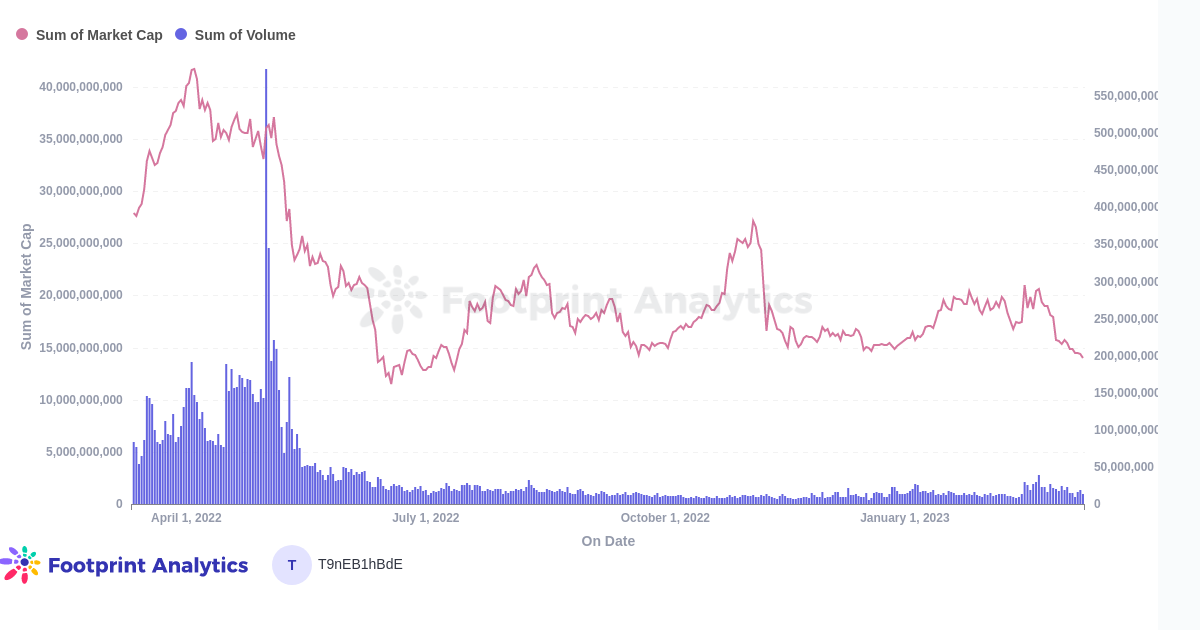

- The market cap of NFTs reached a monthly low of $16B on Feb. 11 but then reached its highest amount since November at $21B

- NFT trading volume through all marketplaces reached its highest amount since May with $1.9B (note that this figure double-counts some NFT values as it includes aggregators). Excluding aggregators, this figure is $521M, the highest since August

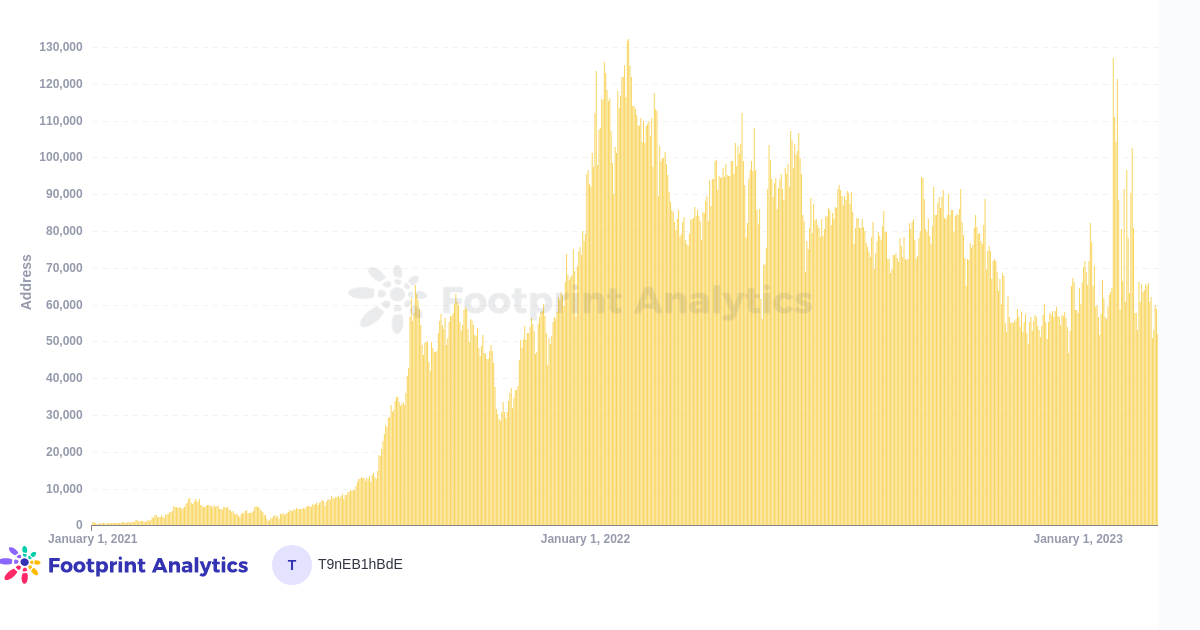

- After a sharp jump in the number of weekly NFTs users in January, this figure came back down in February.

Chains & Marketplaces for NFTs

- Polygon became the second largest chain for NFT trading, with 5.7% of the total

- Solana has lost a significant part of its volume, declining 58.4%

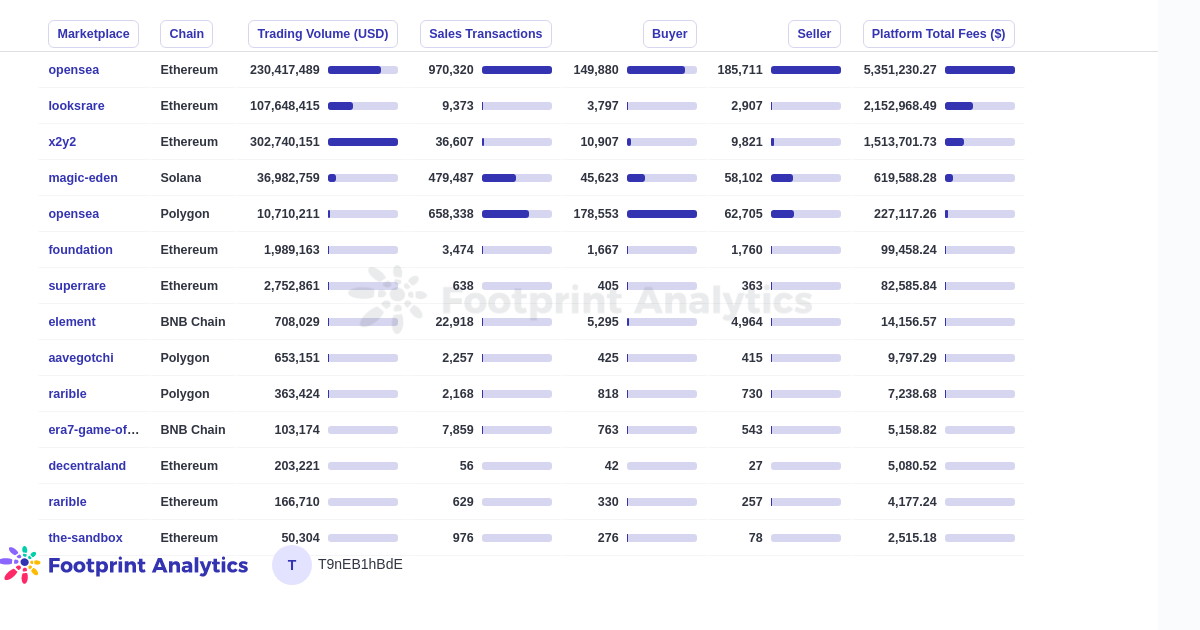

- LooksRare was the second most profitable NFT marketplace after OpenSea, generating y in platform fees

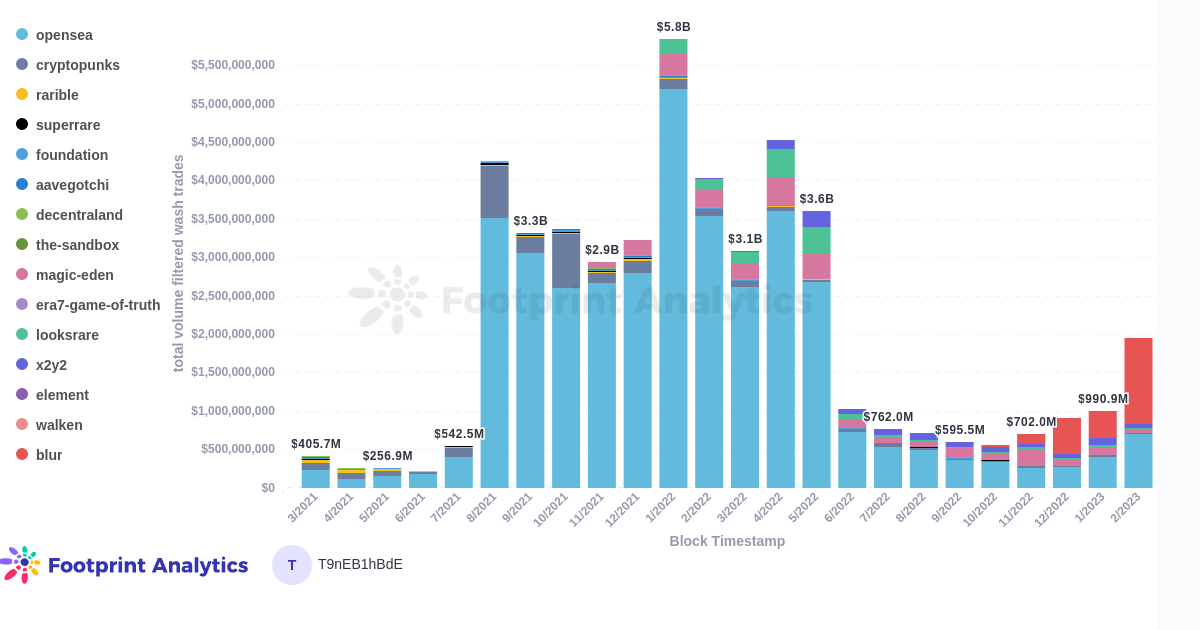

- Blur has become the largest NFT trading platform, going from completely new to 59% larger than OpenSea in 5 months

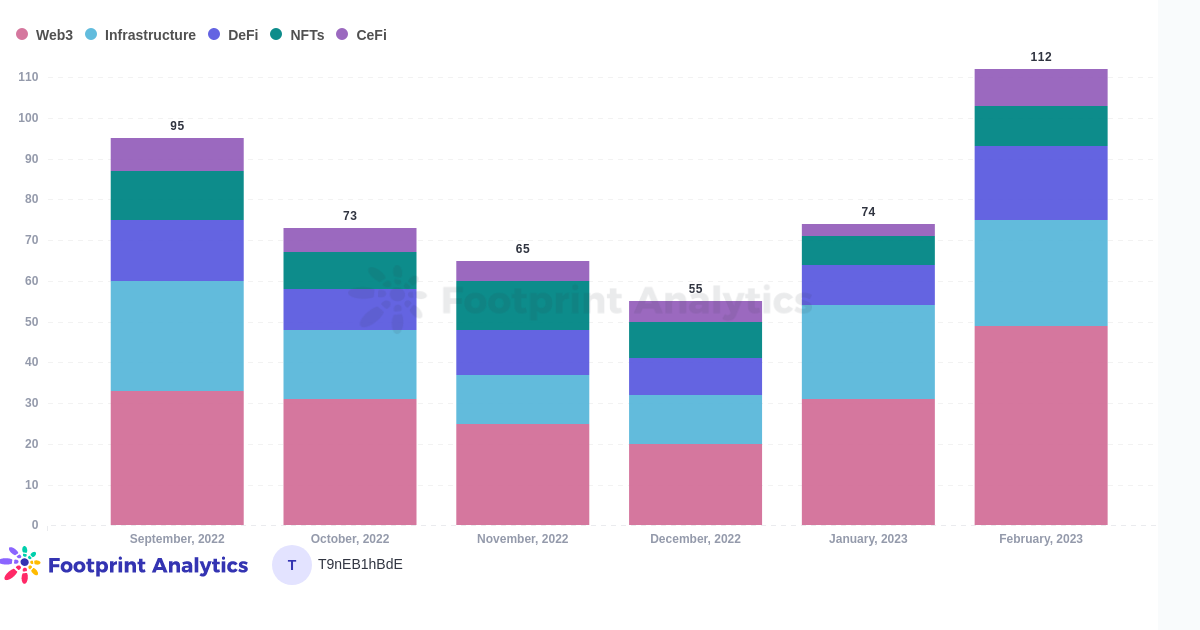

NFT Investment & Funding

- Funding rounds increased slightly, from 7 in January to 10 in February (Note this includes one IPO.)

- Superplastic closed the largest round with a $20M Series A-4, led by Amazon

Crypto Macro Overview

ETH mostly stayed strong off its January recovery, with one stretch of turbulence in the middle of the month, briefly dropping 10% in one week to $1,506

Usually, this statistic would not be notable. However, the S&P 500 index chart looked significantly different over this period, losing 5% from the beginning of February to the end, indicating less and less correlation between the crypto market and traditional securities.

NFT Market Overview

The NFT market had a strong rebound from its monthly low of $16B on Feb. 11 until the end of the month

After the drop on the 11th, this figure then reached its highest amount since November, at $21B. However, the market would then drop back down in March. Being highly volatile and uncorrelated from both the price of ETH and the S&P, the current situation has created an interesting and potentially lucrative market for NFT traders.

NFT trading volume through all marketplaces reached its highest amount since May with $1.9B

NFT Volume by Chain (with Wash Trading Filtered)

Note that this figure double-counts some NFT values as it includes aggregators. Excluding aggregators, this figure is $521M, still the highest since August. This is somewhat expected considering the strong performance of ETH.

After a sharp jump in the number of weekly NFTs users in January, this figure came back down in February

The number of weekly NFT users saw an abnormal jump in January. This figure reverted to the baseline in February.

Chains & Marketplaces for NFTs

Polygon became the second largest chain for NFT trading, with 5.7% of the market total

February was an amazing month for Polygon’s NFT ecosystem, with Binance NFT marketplace integrating with the L2 chain, the popularity of the Coinllectibles project, and Starbucks launching its premium NFTs.

NFT Volume by Chain (with Wash Trading Filtered)

Also, Solana has lost a significant part of its volume, which declined 58.4% MoM

Conversely, the Solana NFT ecosystem suffered in February, which saw large price swings for SOL.

OpenSea remained the most profitable marketplace, followed by LookRare

OpenSea generated $5.3M in platform fees while LooksRare generated $2.1M.

Blur has become the largest NFT trading platform, going from completely new to 59% larger than OpenSea in 5 months

NFT Volume by Marketplace (With Wash Trading Filtered)

Over the last several months, NFT aggregators have been increasingly popular, especially Blur. However, as Footprint explored in a recent article, Blur’s February airdrop catalyzed its growth, allowing it to overtake OpenSea in volume.

NFT Investment & Funding Overview

Funding rounds increased slightly, from 7 in January to 10 in February

This figure includes one IPO, from The NFT Gaming Company, Inc. The other 9 rounds were mostly Seed and pre-Seed rounds, with a couple Series A.

Superplastic closed the largest round with a $20M Series A-4, led by Amazon

Superplastic creates digital influencers, artists and collectibles. Significantly, Amazon has bought into their vision and led their Series A-4, and will support the development of their shows and entertainment offerings.

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.