Bitcoin is approaching a critical level of support following a 5.5% move to the downside just minutes after yesterday’s daily candle close.

The fall in price comes after a rejection at the $10,950 level, with Bitcoin once again failing to prevent a fourth lower high in succession.

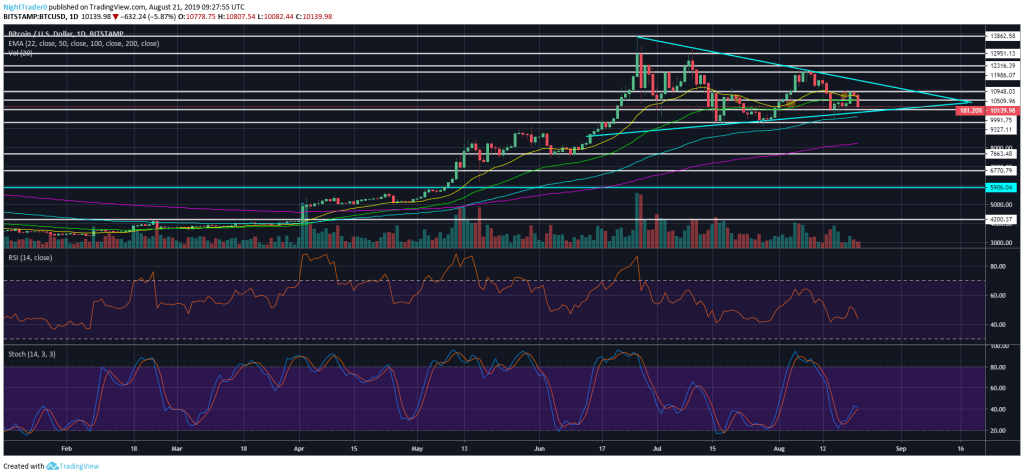

For now, the bulls need to defend the $9,950 level as it comes in confluence with the lower side of the symmetrical triangle that has been forming since July 19.

If the symmetrical triangle breaks to the downside, it is expected that Bitcoin’s price will drop to around $9,600 and $9,350 before potentially testing the daily 200 EMA at $8,250.

However, there is still a bullish case for Bitcoin, which has now been consolidating for two months following the astonishing rise from $3,150 to $14,000 earlier this year.

If support can hold, the upper band of the symmetrical triangle is sloping down to around $11,350, meaning a bullish break at that level could well drive Bitcoin to new yearly highs if momentum can be sustained.

A breakout from a two-month consolidation would almost certainly result in a volatile move in either direction. This was highlighted last autumn when Bitcoin traded sideways for two months before falling by 50% in November.

Bitcoin’s daily RSI has dipped back to the 44 level after being rejected from 53, while the daily stochastics look like they may cross back to the downside in the coming days.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.