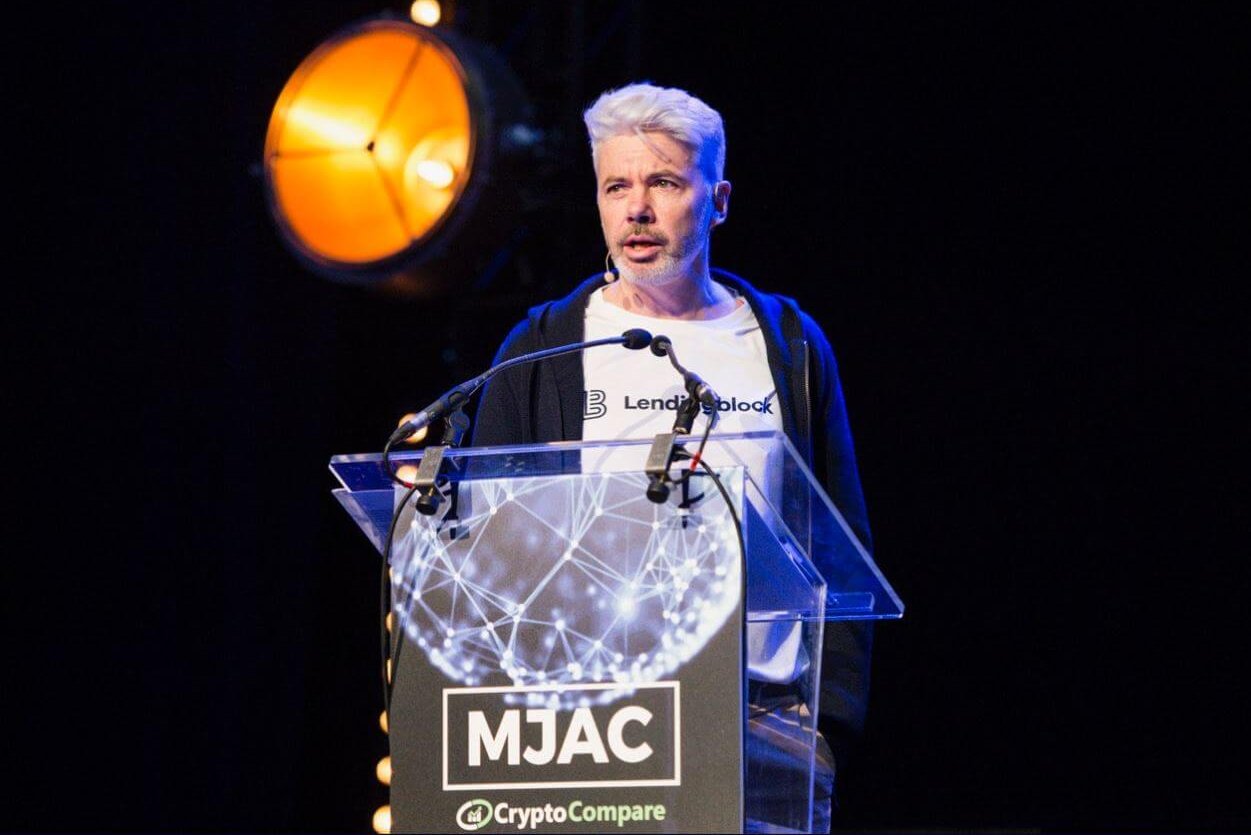

Coin Rivet recently interviewed Lendingblock co-founder and CEO Steve Swain to discuss the upcoming launch of the platform, which allows users to borrow and lend digital assets.

Steve began his career in conventional financial services and spent nearly 20 years working for different investors and banks. While he learnt a lot, he discovered that innovation had shifted away from the markets, and he became intrigued by what was happening in the blockchain space.

“As it started to grow and grow, I realised there was a real once-in-a-lifetime opportunity to get involved and create something new. The opportunity to jump in with both feet and start Lendingblock was too good to turn down,” the CEO told us.

Lendingblock is a platform that is trying to “bring a very strong financial service to the digital asset market that exists in the world of conventional equity and debt services – namely the borrowing and lending of securities between institutions.”

While the lending market in the crypto space is growing, Steve believes that Lendingblock is the only platform focused on the institutional market.

He claims other lending platforms focus on the retail market and not so much on the institutional side.

“So we’re very squarely targeted on building a fully scalable platform for the institutional market, which we think will become the backbone of secured finance in the market,” adds Steve.

Lendingblock wants to work with bigger names and is entering into partnerships with people that have broader client bases.

“Our focus is being the infrastructure provider and not trying to have a direct relationship with every client,” Steve continues.

Because Lendingblock’s focus is on the institutional market, the assets it will deal with will largely depend on institutional demand. At present, this means the top ten cryptocurrencies by market capitalisation as well as a stablecoin.

The choice to work with a stablecoin is because Lendingblock believes the ability to have a dollar equivalent without having an actual dollar is “really important”.

Lendingblock is currently getting its final regulatory approval from Gibraltar and will launch once this has been achieved.

“Asset security is absolutely at the front of everything we do,” claims Steve.

“It’s one of the reasons we went through the trouble of getting regulated because we wanted someone independent to look at what we’re doing and say that not only are we a company that can be trusted, but that we have an infrastructure and architecture instead of practices, which means the assets are safe.”

The assets go to Lendingblock via the setup of a loan, and once the loan has been established, the company looks after the collateral. Part of the time the collateral is held in its own secure wallet infrastructure, but the collateral assets are also moved into the cold storage of a custodian. This means that for the duration of the loan, the collateral is kept safely inside of a cold wallet.

Having a secure infrastructure is highly important because, as Steve tells us, Lendingblock is anticipating that the loans will range between $100,000 and $10 million per loan upon launch.

Lendingblock will also conduct strict Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks as well as “blockchain analytics” on the assets that are being used. It will look into the transactions, the assets, and the wallets used to make sure that there are no compromised Bitcoins coming through the platform.

Once the user has been through the relevant KYC and AML checks, the Lendingblock platform can be used to arrange fully collaterised loans between two participants.

Users are able to make borrow orders or lending offers in the same way you make orders through an exchange.

“We don’t set prices, the market sets prices. That’s really important because it gives everybody complete transparency about the depth of demand for borrowing or lending supply.”

Lendingblock, however, is neither the borrower nor the lender. The borrower sends the collateral to the platform and the lender sends the principle, and once Lendingblock has received both, the principle is delivered to the borrower and the collateral is moved to cold storage.

The platform then starts the process of managing the collateral levels. It continuously monitors the amount of collateral that’s been provided to make sure that it stays within the safe margin zone for the duration of the loan.

If it doesn’t, Lendingblock will make a margin call to the borrower to top it up, and in extreme circumstances, it will step in and liquidate the loan so that the asset the lender has provided is always safe.

When discussing Lendingblock’s upcoming plans and its roadmap, the co-founder and CEO of the platform revealed beyond adding additional assets, the company will look into extending the loan period.

At the moment, the current loan size is 30 days, though the company is currently looking into the possibility of extending this up to six months. Ultimately though, additional tweaks will be dependent on customer demand.

Lendingblock recently had its site inspection by the Gibraltar regulator, which Steve revealed was the culmination of a “12-month process and preparation”.

“We’re very pleased with how that inspection went. Once we receive final feedback from them – which we expect fairly quickly – then we’ll be in position to officially launch.

“What we have been doing on the platform are loans at a very small value that participants are able to test out. So, we’ve been in dress rehearsal mode, but the official announcement is sometime in the very near future.”

As we neared the end of the interview, Steve added: “We’re very pleased to be part of what is becoming a rapidly more mature and better conducted financial market infrastructure, and it has enormous potential ahead of it.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire