Despite being one of the earliest blockchains to launch, NEO has fallen behind Terra, BSC, Avalanche and Solana in attracting diverse projects to its ecosystem. NEO’s TVL has also been in steep decline, despite an opposite industry-wide trend of rapid growth.

Where did this platform, which once looked like it could compete with Ethereum, go wrong? And, could its recent upgrade succeed in attracting more projects and developers?

NEO, formerly known as Antshares, is a blockchain platform, cryptocurrency and network for building decentralised applications (dApps).

It integrates digital assets, digital identities and smart contracts into one ecosystem that enables a distributed network.

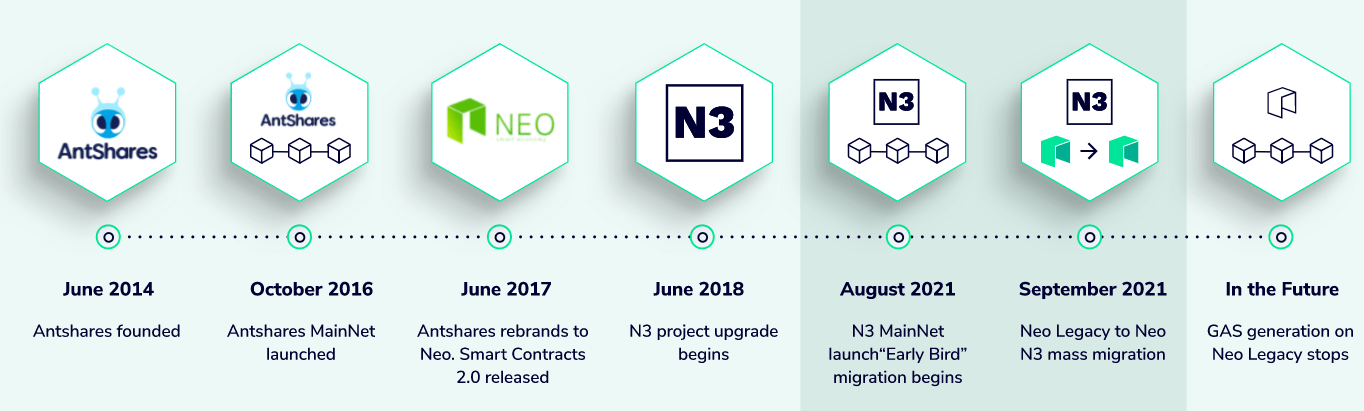

Through a series of upgrading , from rebranding of NEO to N3 and mass migration, NEO has developed to improve its stability.

Screenshot source: NEO’s development history

According to Footprint Analytics, as the industry moves forward, NEO’s recent upgrade and migration in September has seen a decline in TVL instead of growth, with a TVL of $50.43 million as of Dec. 20, compared to a TVL growth rate of -84% as of May 6.

However, NEO’s TVL is on a downward trend, which is closely related to its economic model and the development of the ecosystem.

Footprint Analytics: NEO TVL

NEO N3 inherited its economic model from NEO Legacy, with a dual Token model, NEO and NeoGas (GAS), where NEO is used for governance and GAS is used for circulation.

NEO says the upgrade optimised the ecosystem’s economic model by increasing community participation in governance. Now, 80% of the GAS generated from each block will be distributed to voters who vote for the NEO Board, 10% will be distributed to all Board members, and the remaining 10% will be distributed to all NEO holders.

This dual token model promotes long-term holding via NEO dividends, while also enticing more users to join the ecosystem.

According to Footprint Analytics, NEO’s token prices and trading volume are as follows:

Footprint Analytics:GAS Price & NEO Price

Footprint Analytics:GAS Trading Volume & NEO Trading Volume

Footprint Analytics: Flamingo Finance TVL

Compared to chains with DeFi, GameFi and NFT usage cases, NEO’s ecosystem is relatively simple. According to Footprint data, NEO’s TVL mainly comes from Flamingo Finance. It makes up 100% of NEO’s TVL.

The NEO Foundation announced its investment in the incubation of Flamingo Finance (referred as Flamingo), a NEO-based DeFi platform that is a comprehensive DeFi protocol integrating asset cross-chain, AMM, synthetic stablecoin, contract trading and pledge rewards.

Flamingo will leverage Poly Network’s cross-chain protocol to enable cross-chain trading support in the DeFi ecosystem, where users can use assets such as BTC, ETH and stablecoins as pledges. Provide liquidity for Flamingo asset transactions, resulting in FLM token rewards.

Footprint Analytics:FLM Price & Trading Volume

According to Footprint Analytics, Flamingo’s Token FLM price has been below $1 since launch, with an average trading volume of between $20-$30 million.

On December 6, Flamingo completed a major upgrade to the NEO N3 mainline and the migration of assets from NEO Legacy to NEO N3 has begun. The FLM incentives generated during the migration will be migrated from NEO Legacy to NEO N3 in incremental steps within 30 days.

Flamingo can grow depending on the depth and scale of its community participation, and needs to bring in more quality assets from other blockchains as well as new protocols or products to participate in the construction of Flamingo’s DeFi, so as to gain more possibilities for growth.

NEO is one of the earliest blockchain projects, providing a smart contract platform with stable operation and reasonable allocation mechanism. However, compared with fast-growing public chains such as Terra, Avalanche and Solana, NEO is very undiversified, with only one major project—Flamingo Finance—propping up the ecosystem.

To grow, NEO needs to

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire