DeFi platforms Raydium and Serum have established a partnership to bring cross-chain assets and growth to the thriving Solana ecosystem through an initiative designed to ‘drive trading, bridged assets, and liquidity on Solana’.

The partnership will help Raydium and Serum prepare for a cross-chain future through a number of improvements to Solana DeF including an integral focus on cross-chain assets and improvements to the native Solana bridge, ‘Wormhole’.

AlphaRay, the founder of Raydium, noted that their working relationship with Serum remains strong as their “goals to bring users and trading to Solana have always been aligned” and that the alliance “was a no-brainer for us and helps to really cement our partnership”.

The Solana ecosystem is thriving, but there's still big opportunity in the cross-chain galaxy 🚀✨

That's why Raydium is partnering with @ProjectSerum to drive trading for cross-chain assets & launch Fusion Pools w SRM rewards!

Check out details below:https://t.co/dgVvgjzlrw

— Raydium (@RaydiumProtocol) November 8, 2021

Via the initiative, users on Raydium will be able to ‘bridge’ popular assets from Ethereum such as Shiba Inu (SHIB), UniSwap (UNI) and Axie Infinity (AXS) and utilise them in a number of incentivised “fusion pools” on the platform.

AlphaRay spoke further to CoinRivet on how the partnership will benefit Raydium and the Solana DeFi ecosystem as a whole.

“This is how we’ll onboard the next million users,” he said.

“We want to show them what Solana has to offer. Solana has all the infrastructure these users are used to on Ethereum but with near-instant confirmations and gas fees as low as $0.00025.

“By bringing popular ERC assets over to Solana to trade, current Solana users will also be able to take part in all the hot and exciting tokens which pop up on Ethereum while enjoying Solana’s speed and low cost.”

Both Raydium and Serum remain two of the most popular DeFi platforms in the Solana ecosystem, respectively boasting $2.07bn and $1.85bn in total value locked (TVL) and securing the number one and three spots in the Solana DeFi rankings.

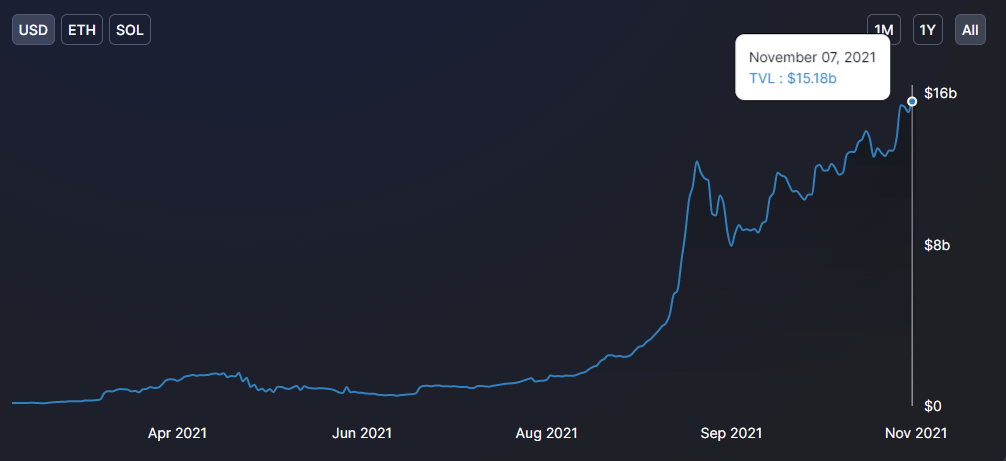

The TVL on Solana is now close to $16bn Source: Defillama.com

Both offer similar products via yield farming through liquidity pools and DEX capabilities for trading and swaps. To bring even more liquidity and TVL to Raydium, the platform will be operating a liquidity mining initiative to drive liquidity to the platform and pool.

Over the coming weeks, approximately 4m Serum (SRM) will be allocated to LP incentives alongside additional RAY rewards.

AlphaRay noted the importance of the introduction of cross-chain assets to the protocol and how it will affect the ecosystem.

“We think that incentivising cross-chain assets will increase their liquidity and popularity,” he said.

“By bringing these users over to Raydium to trade, they’ll also explore the wider ecosystem and be able to easily trade Solana-native assets, participate in IDOs and NFT drops on Raydium, and earn yield on their assets.”

Finally, to help encourage and incentivise bridging to Solana, Raydium will be working with an array of partner teams to enable decentralised bridging for cross-chain assets through the ‘Wormhole’ bridge.

The bridge will also be directly integrated into the site for easier access and a greater user experience.

AlphaRay said the addition of the bridge “will be huge” for Raydium and that it is the “first step to making Raydium and Serum the decentralised trading hub for any asset on any chain”.

He additionally laid out Raydium’s vision of the bridge and its vast capabilities, saying “we envision a world where DeFi users can trade any asset at lightning-fast speeds, low cost, and a fully integrated order book”.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.