The new year couldn’t have got off to a better start for cryptocurrency enthusiasts.

After the significant Bitcoin pump that took place early in the year, where the price of BTC increased close to 20% in the space of a few days, it seems the market has now stabilised.

Meanwhile, even with Bitcoin’s rise, some top altcoins have experienced some impressive gains versus the world’s pre-eminent cryptocurrency.

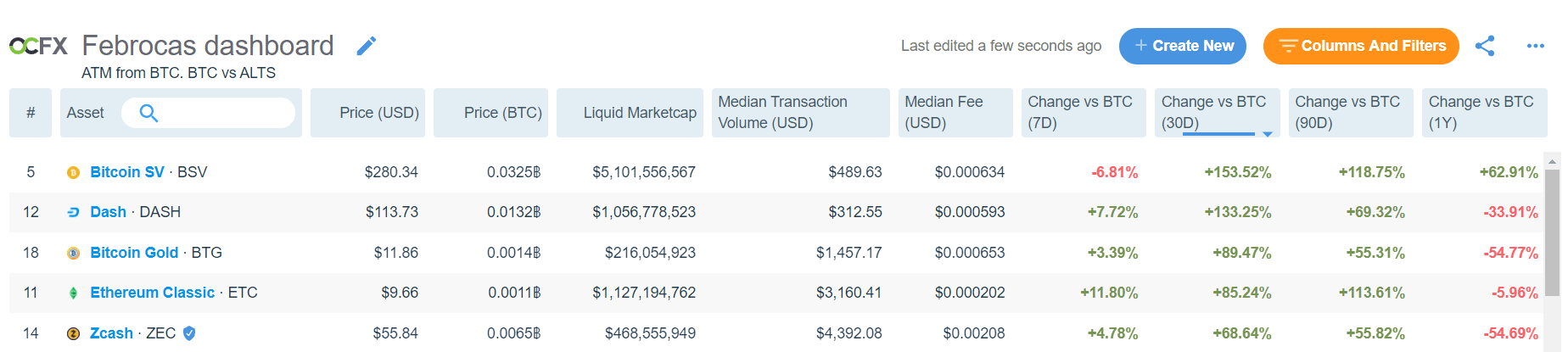

Let’s take a look at the top altcoins that have outperformed Bitcoin so far this year, courtesy of Mesari.io.

As you can see, the top-performing altcoins in January are Bitcoin SV, Dash, Bitcoin Gold, Ethereum Classic, and Zcash.

However, looking at the last column, with the exception of Bitcoin SV, most altcoins are still well below their all-time highs versus Bitcoin.

Nevertheless, today my goal is to look into which altcoins might help you increase your Bitcoin portfolio in the short term.

During January 2020, some altcoins doubled in price versus Bitcoin, meaning you could conceivably greatly increase your Bitcoin holdings if you spread your investment out to include some top-performing altcoins and then convert your profit back into Bitcoin.

As always, the views in this article should not be considered financial advisement. The volatility of the crypto markets means money can easily be lost. Never invest more than you can afford to lose and always do your own due diligence.

Let’s take a look at the top three coins of January 2020: Bitcoin SV (BSV), Dash (DASH), and Bitcoin Gold (BTG).

Above we can see the chart for Bitcoin SV vs Bitcoin, courtesy of TradingView. BSV has been performing quite well versus BTC in 2020 so far.

At the time of writing, BSV has pumped from 1,300,000 sats to nearly 3,300,000 since the start of the year. That represents a 153% gain since early January 2020.

All of Bitcoin SV’s EMAs are currently spiking as well, and the 20-day EMA has crossed both the 50-day and 200-day EMAs. If the trend continues, I expect BSV to continue making new highs.

In my last BSV price analysis, I underlined how the next target was around 3,400,000 sats. It seems BSV is coming close to breaching said target to keep the positive momentum going a bit longer.

As long as volume does not decline too much, I don’t see a reason why BSV couldn’t keep pumping over the next few months.

Dash is a popular altcoin among a great deal of cryptocurrency investors and traders.

Since its early “DarkCoin” days, Dash has been attempting to solve scalability and privacy – two major issues for many crypto-enthusiasts.

Looking at the chart above, again courtesy of TradingView, we can quickly see Dash has been performing quite well during January 2020.

Essentially, the altcoin has grown close to 135% in the span of 30 days against Bitcoin, going from around 600,000 sats to 1,600,000 sats.

If the altcoin is capable of sustaining its current volumes and stays above the 200-day EMA (blue line), we could see its momentum keep going for longer.

Much like Bitcoin SV, Bitcoin Gold is yet another hard fork of the Bitcoin Core software.

Since early January 2020, BTG has grown over 80% versus BTC. At its height two weeks ago, the altcoin peaked close to 130%. Price now seems to be struggling to maintain its positive momentum.

If BTG is capable of sustaining its price above the 200-day EMA, we could see new highs for Bitcoin Gold.

At the moment, BTG is trading close to 136,000 sats. If the altcoin breaks to the upside, we could see 200,000 sats soon, since the volume profile shows little resistance until then.

If the opposite happens, BTG could drop down to its 50-day EMA at around 105,000.

Safe trades!

Disclaimer: The views expressed in this article are the author’s only. This article isn’t financial advice or promotional material; it represents my personal opinion and should not be attributed to Coin Rivet.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire