The US stock market has suffered a turbulent week in light of the ongoing trade war between the US and China.

Having rallied to all-time highs just weeks ago, the S&P 500 crashed back to reality this week by falling more than 6.5% in three days.

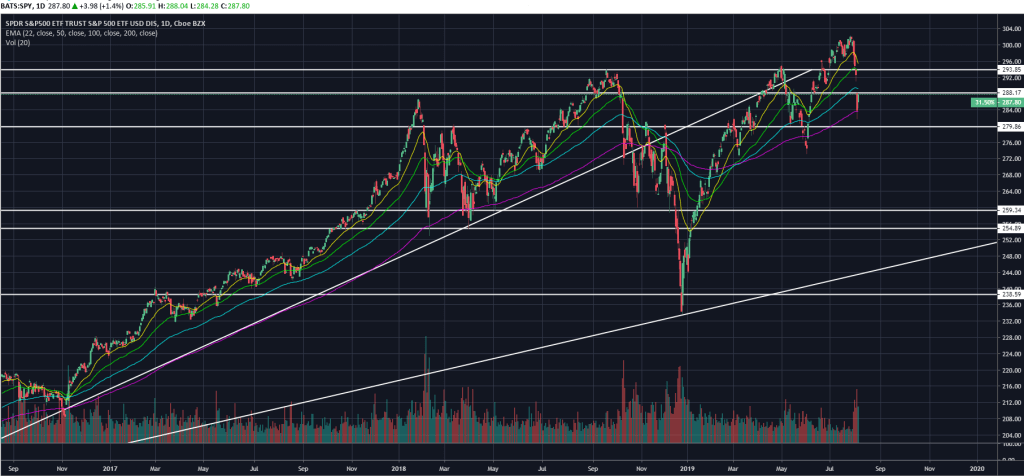

Support finally came in at around 283, with the 200 exponential moving average (EMA) on the daily chart propping price up above the 280 level of support.

The S&P 500 then registered its biggest one-day rise in two months on Tuesday, surging back to the 288 level of resistance.

There is a notable gap to fill between 288 and 291, but this could be filled in the coming days as confidence and optimism re-enters the market.

After Wall Street closed for trading on Monday, the US Treasury labelled China a “currency manipulator”, although the White House is keen on continuing trade talks with China ahead of the September 1 deadline for new tariffs on Chinese imports.

Massive amounts of money from China and other parts of the world is pouring into the United States for reasons of safety, investment, and interest rates! We are in a very strong position. Companies are also coming to the U.S. in big numbers. A beautiful thing to watch!

— Donald J. Trump (@realDonaldTrump) August 6, 2019

The US market wasn’t the only market to be hit either. London’s FTSE also saw a 0.7% decline while currency markets continued to suffer.

The US dollar rallied against its Chinese yuan pair, while the British pound is turgidly grinding against its lowest level since 2017 at $1.21.

However, the US dollar has struggled against the Japanese yen, falling to as low as 105.65 before experiencing a 0.68% bounce to the upside.

For more news, guides, and technical analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.