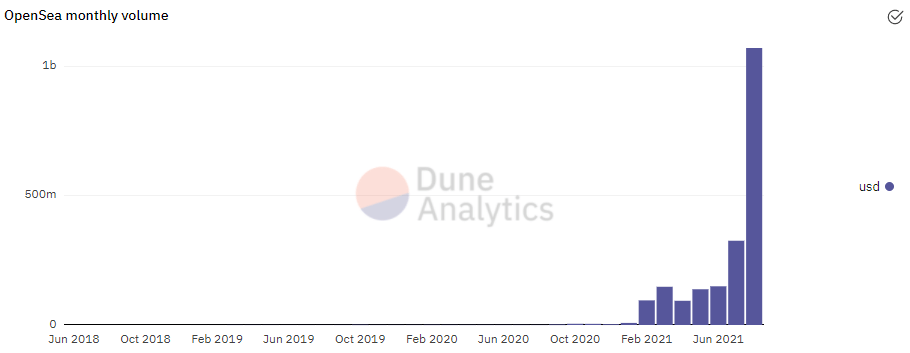

Trading volumes on NFT marketplace OpenSea have continued their rapid ascent following the return of NFT mania.

According to data from Dune analytics, OpenSea has recorded monthly volume figures of more than $1bn, or approximately 351,000 ETH for the month of August so far and more than tripled the recorded monthly volume for July of $325m.

Additionally, data from Dappradar shows that OpenSea has seen a 931% increase in trading volume over the past 30 days. The data also shows OpenSea has recorded 1.4m transactions – a 168% increase over the same period.

The increased activity on OpenSea coincides with Ethereum’s latest rally, which has seen the asset move by 70% following recent lows of $1,700 to a high of $3,343. The resurgence of Ethereum has seemingly kickstarted the NFT space and lead to the record-breaking figures being achieved by OpenSea.

With ETH 2.0 in the development pipeline in anticipation of Ethereum’s transition to a proof-of-stake network, the ETH 2.0 staking contract has seen record inflows, and marks the increasing interest in the asset. In tandem with the EIP-1559 upgrade, this has prompted a surge of interest in Ethereum and has lead to increased rumours of major institutional interest in the asset.

Since the inception of the network upgrade on August 5 2021, more than 60,000 ETH has burned thus far, with OpenSea leading the way on the burn charts. OpenSea has contributed to burning 7,664 ETH, equivalent to almost $23m based on current ETH prices.

OpenSea’s popularity has also seen its platform overtake UniSwap and leading NFT game Axie Infinity on the ‘burn leader board’.

Additionally, according to data from The Block, Google search results for “OpenSea” also reached record highs as they reached 100, which is the highest possible result and indicates that interest is ever-increasing in OpenSea and NFTs.

Data from OpenSea indicates the most popular asset over the past 30 days are CryptoPunks. They have contributed to 117k ETH, or over $350m worth of volume on OpenSea, with a majority of Punks sold reaching incredible prices of up to $900,000.

OpenSea competitors on other blockchains have also seen a surge of interest in NFTs following the launch of the Degen Ape collection on Solana. The NFT collection launch coincided with recent Solana all-time highs and showed that competing blockchains can, somewhat temporarily, eat into OpenSea’s almost unassailable market share.

OpenSea also recently received $100 million in funding from investors in a Series B round led by venture capital firm A16z. OpenSea disclosed it wished to use the funds to make NFTs more accessible to mainstream users by expanding into global markets and supporting multiple blockchains.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire