The current Ripple business model is to develop and sell software built on top of XRP, the Ripple cryptocurrency. The three primary software products developed by Ripple are xCurrent, xRapid, and xVia.

Let’s take an in-depth look at each one and explain what their purposes are within the current Ripple ecosystem.

What’s included in the Ripple product suite?

xCurrent – Used to process payments

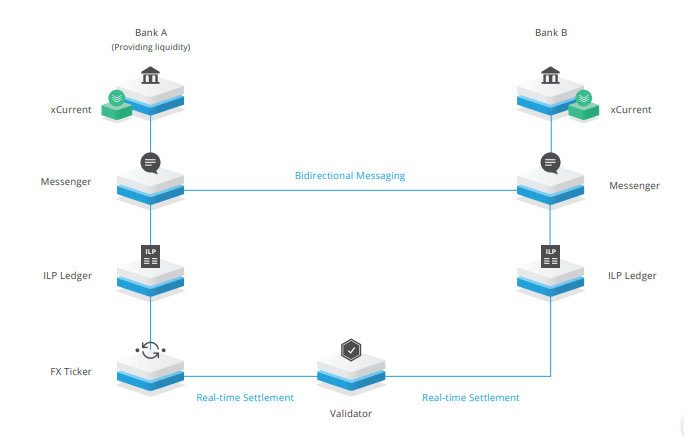

xCurrent is an interbank communications and settlement software built around the Interledger Protocol (ILP). The ILP is an open protocol that enables interoperation between different ledgers and payments networks.

xCurrent is Ripple’s enterprise software solution and enables banks to instantly settle cross-border payments with end-to-end tracking. Using xCurrent, banks message each other in real time to confirm payment details prior to initiating the transaction and to confirm delivery. It includes a Rulebook developed in partnership with the RippleNet Committee that ensures operational consistency and legal clarity for every transaction.

The solution offers a cryptographically secure end-to-end payment flow with transaction immutability and information redundancy. It is designed to comply with each bank’s risk, privacy, and compliance requirements. Because the software is built to fit within banks’ existing infrastructure, it minimises integration overhead and business disruption.

xCurrent is comprised of two primary layers:

- The first layer is a communications protocol that is used to perform tasks like validating payment information and transferring funds.

- The settlement layer ensures that funds are committed on both sides and then simultaneously releases the committed funds to each side.

By leveraging distributed ledger technology, xCurrent increases the efficiency of interbank communication by allowing banks to settle transactions (especially multi-currency transactions) faster with transparency and integrity. xCurrent is currently Ripple’s most popular product among its clients.

xRapid – Used to source liquidity

![]()

xRapid is a software solution to provide liquidity, which allows companies to swap in and out of XRP to optimise exchange rate efficiency. In simple terms, XRP can be used in xCurrent as a bridge currency to settle transactions. Without a bridge asset, the spreads can be quite high between infrequently traded currencies, which results in expensive trades.

xRapid is for payment providers and other financial institutions who want to minimise liquidity costs while improving their customer experience. Because payments into emerging markets often require pre-funded local currency accounts around the world, liquidity costs are high. xRapid dramatically lowers the capital requirements for liquidity.

xRapid uniquely uses a digital asset, XRP, to offer on-demand liquidity, which dramatically lowers costs while enabling real-time payments in emerging markets. Built for enterprise use, XRP offers banks and payment providers a highly efficient, scalable, reliable liquidity option to service cross-border payments.

xVia – Used to send payments

![]()

This product is the last stage in Ripple’s product ecosystem. xVia is a standardised payment interface into RippleNet (the network of financial institutions using xCurrent or xRapid to settle payments) designed for corporations, payment providers, and banks who want to send payments across various networks using a standard interface. xVia’s simple API requires no software installation and enables users to seamlessly send payments globally with transparency into the payment status.

xVia has three major selling points:

- Payments tracking: on demand with tracking and delivery confirmation, even in non-traditional networks, like wallets.

- Capital efficiency: free up capital sitting idle in foreign currency transaction accounts with on-demand and real-time global payments.

- Rich data transfer: significantly improve the reconciliation process through rich data including invoices attached to payments.

By combining all three products, Ripple is able to offer its customers a truly unique crypto-banking experience, tackling the major issues currently criticised in traditional banking: high transaction costs and high resource inefficiencies.

Source: https://ripple.com/

We hope you enjoyed our guide. For more guides on cryptocurrencies, exchanges, and blockchain technology, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.