Stablecoins refer to a class of cryptocurrencies which offer price stability and/or are backed by reserve asset(s). They provide cryptocurrency traders and investors with an easy and simple way to keep value without losing to price swings.

Alternative types have emerged, backed by a multiplicity of assets, ranging from baskets of cryptocurrencies to physical assets.

| Purpose of Token | Types | Backed by | Examples |

| Non-volatile cryptocurrency

store of value |

Centralised

Decentralised |

Fiat-Currencies, commodities,

cryptocurrencies, algorithms |

TrueUSD, Tether, DAI, Digitex Gold Token, |

To date, three proper stablecoin models have emerged:

- Fiat-based stablecoins are backed by cryptocurrency exchange Bitfinex, or TrueUSD, a USD-backed ER20 stablecoin that is fully collateralised and legally protected.

- Asset-based stablecoins, such as commodities (gold, silver, oil) or baskets of cryptocurrencies. The most prominent example is Digix Gold Tokens, a cryptocurrency backed by gold.

- Algorithm-based stablecoins, or Seniorage stablecoins, which are based on smart contracts (and other mathematical-based algorithms) to keep the price of the asset stable. A great example is MakerDAO’s DAI, which holds smart-contract reserves of ETH in a 3:1 ratio.

Just like any other cryptocurrency, stablecoins offer some risks and benefits connected to each alternative governance and price-stability models. As such, let’s dive-deep into each dimension to better learn how to mitigate risks and unlock the benefits of stablecoins.

Risks of stablecoins

Although there are many benefits to stablecoin, there are a number of bottlenecks to be aware of. We explore each of them below and how the issues can be addressed.

- Counter-party risk: by trusting a third-party to print money and keep a cryptocurrency stable, the dollars could be fractionally reserved instead of fully backed/ In this case, a bank run could cause the price of the coin to drop dramatically.

- Centralisation risk: accounts can be embezzled, blocked, or accessed by unauthorised third parties. Centralisation risks mean the same monetary issues fiat-currencies face when a central authority has the power to print money without oversight. This can potentially lead to hyperinflation.

- Algorithm manipulations: as most decentralised stablecoins live within smart contracts in protocols like Ethereum or Stellar, there’s a risk the algorithm which keeps the currency stable fails. Algorithms could even be manipulated by a third-party. Because “code is law”, updates to the network can have an impact on previous smart contracts – a huge hassle for decentralised projects.

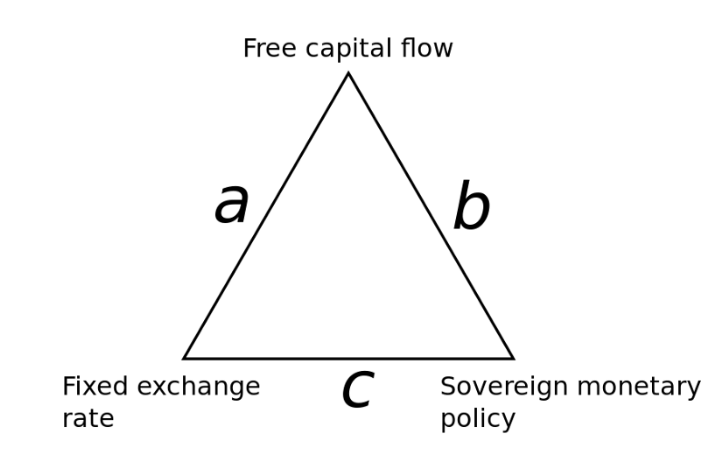

As the Bitcoin Maximalist developer Jimmy Song explains, stablecoins suffer from a trinity problem. They need to lose their sovereignty in order to keep the price stable. However, by relinquishing control to a certain entity or single contract, there are increased risks.

“Clearly, a stablecoin to be stable needs to have #3. #2 is what makes a cryptocurrency useful. #1 is the only way that any of these stablecoins can make money. You can only have 2 of these three and for Bitcoin, #3 is what is sacrificed and hence the fluctuations in price. Stablecoins are trying to get all three and it’s usually done in a way as to hide the risk involved.”

Benefits of stablecoins

There are many benefits to using stablecoins with some of the most important ones listed below.

- Global commerce opportunity

This feature will be especially important for people living in countries with unstable monetary systems, such as Argentina, where residents are often exposed to rampant inflation and uncertainty. Even when these citizens seek to move their capital to more stable stores of value, restrictive capital control laws often prevent them from using non-native currencies in transactions outside the country. Hence, why decentralised stablecoins matter a lot! - Decentralised financial services

The adoption of stablecoins will support capital market formation and usher in new applications for decentralised finance on the blockchain. These include lending and derivatives markets because without borders and volatility, it becomes easier to lend money. - Great tool for traders

Traders and investors can change between cryptocurrencies, without being exposed to asset volatility. Stablecoins enable traders to keep value stable against a fiat currency, usually the dollar, while they’re in-between trades.

Conclusion

Ultimately, decentralised currencies pave the way for a modern financial revolution that will remove inefficiencies, reduce risk stemming from centralised parties and change the way we transact. We shouldn’t forget, however, stablecoins are a centralised cryptocurrency that happen to be stable with the dollar. In that sense, it’s a lot more practical than almost every altcoin, offering a greater level of stability to each user.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.