Tokenomics is a new and evolving field of financial literacy. Knowing the ins and outs of this exciting field will help you navigate your way to finding fundamental value in tokenised projects.

Let’s talk through some key factors to look out for as you are evaluating value for different tokenised projects:

What is actually going on?: For any project the best place to start would be the official website. You should be able to take away in only a few minutes what the stated use case and business model will be for any tokenised project. A key area you should look out for is the potential demand for the utility that the token is offering. It’s good to try and think about other businesses trying to go after the same customers; without being on the blockchain of course. If you can find other businesses you should look into how profitable they are and if that business is in growth or not.

Supply of tokens: Token supply is a ‘must-check’. You need to understand this metric to work out what the total market cap of the tokens is (multiple token supply by average traded price). You can compare this market cap figure in relative size to other key metrics. If you can’t find the total current supply of a particular token, then this is a red flag for any project. If the token’s on Ethereum then check etherscan.io. If it’s a native blockchain then try and find a block explorer for the project.

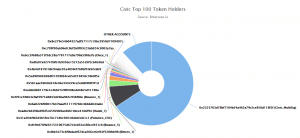

Concentration of tokens: This relates to the number of tokens (in issuance today) that are centralised in a wallet or with a stakeholder. An example stakeholder could be the treasury/foundation for the project. Concentration can sometimes be a good and bad thing. If tokens are largely spread between over a large number of addresses it could point towards a large user base with good decentralisation characteristic.

Locked up tokens: This relates to any tokens which are ‘cryptographically’ locked up. This means that absolutely no one can release a certain supply of tokens until the smart contract is unlocked. The parameter is usually time, but it can also be other criteria. This type of feature demonstrates long-term incentives and belief in a project, due to a reduction in token supply.

Burned tokens: Burning tokens is a strategy used by several projects to decrease the overall supply of tokens. The burn rate is usually linked to a parameter being tracked as part of the business model of the project. A great example of this is Binance’s native token (BNB). Every quarter a number of these ERC-20 tokens are cryptographically burned in proportion to profits generated from the exchange (BNB token can be used as a pre-payment of trading fees at Binance).

Token flow: Flow can be measured in a few ways. It could relate to the daily trading volume (as a percentage of market cap) but a better measure, especially for dApps, would be the flow of specific tokens through smart contracts. A good place to check out this data would be either dappradar.com or stateofthedapps.com. Both these websites keep track of dApps across the EOS and ETH ecosystems. For each project, you can monitor key information like the volume of transactions through a contract address or the number of unique users using the application in a set time period.

GitHub repository: Many projects have an open GitHub repository which hosts open source code – again, another red flag if you can’t find one. A great place to check out this data is coinpaprika.com. On the site you can click on the community tab and then see some key statistics on the right-hand side of the screen. Two key attributes to look out for are Stars (think of this as the number of accounts subscribed to a repository) and contributors. The one-month commits are also a useful indicator to evaluate recent activity. A commit is a single proposal from someone to change an element of the codebase (does not mean that this change was approved or not).

Community: Most crypto projects have a presence across several social media channels. The main channels to track would be Twitter, Reddit and Telegram. Again, using data from coinpaprika.com you can see the number of Twitter followers, the number of subreddit subscribers and the members in their Telegram group (all this information can be seen in the community tab).

Conclusion…

It’s not easy to find value in many tokenised projects. Our recommendation to anyone researching this space would be too look for the real value in what a project is creating in terms of its business model. There are many projects out there with lots of funding and slick marketing material. Don’t be taken in by the hype and make sure to look a little deeper for your due diligence.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.