NFT portfolio manager NFTBank has integrated with Chainlink to make its market data available on-chain for use on decentralised finance applications.

The integration will enable NFTBank to outsource price data from non-fungible tokens such as CryptoPunks and Bored Ape Yacht Club (BAYC) for use on-chain by leveraging Chainlink Oracles, which ensure that accurate and reliable price data is supplied to DeFi apps.

The availability of the price market data now opens the doors for innovative products using NFTs, including the use of a digital collectable as collateral for DeFi loans and the ability to ‘fractionalise’ the ownership of digital collectables.

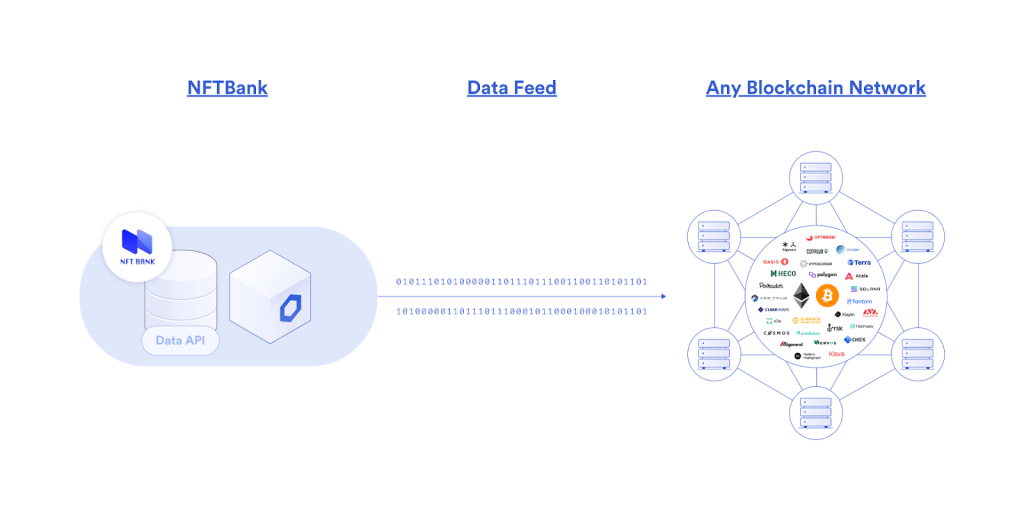

Chainlink’s oracle technology will enable NFTBank to outsource market data to DeFi applications across multiple blockchains

NFTBank chose Chainlink to deliver the data on-chain due to the “secure and future-proof oracle technology” quickly becoming the industry standard for data providers alongside allowing the platform to connect instantly to the array of blockchains and Layer-2 platforms on the market.

Focused on creating a better dashboard for consumers and providing yield-based returns, the platform’s long-term ambitions include expanding the ecosystem further by providing quality tools and features that can unlock “high-potential use cases” for NFTs.

“By making CryptoPunks and BAYC market data available to smart contracts through Chainlink, we’re both maximizing the number of developers we can reach with our NFT valuation data and increasing the utility of blue-chip NFT collections,” said Jen Kim, Head of Product at NFTBank.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.